Tax Information

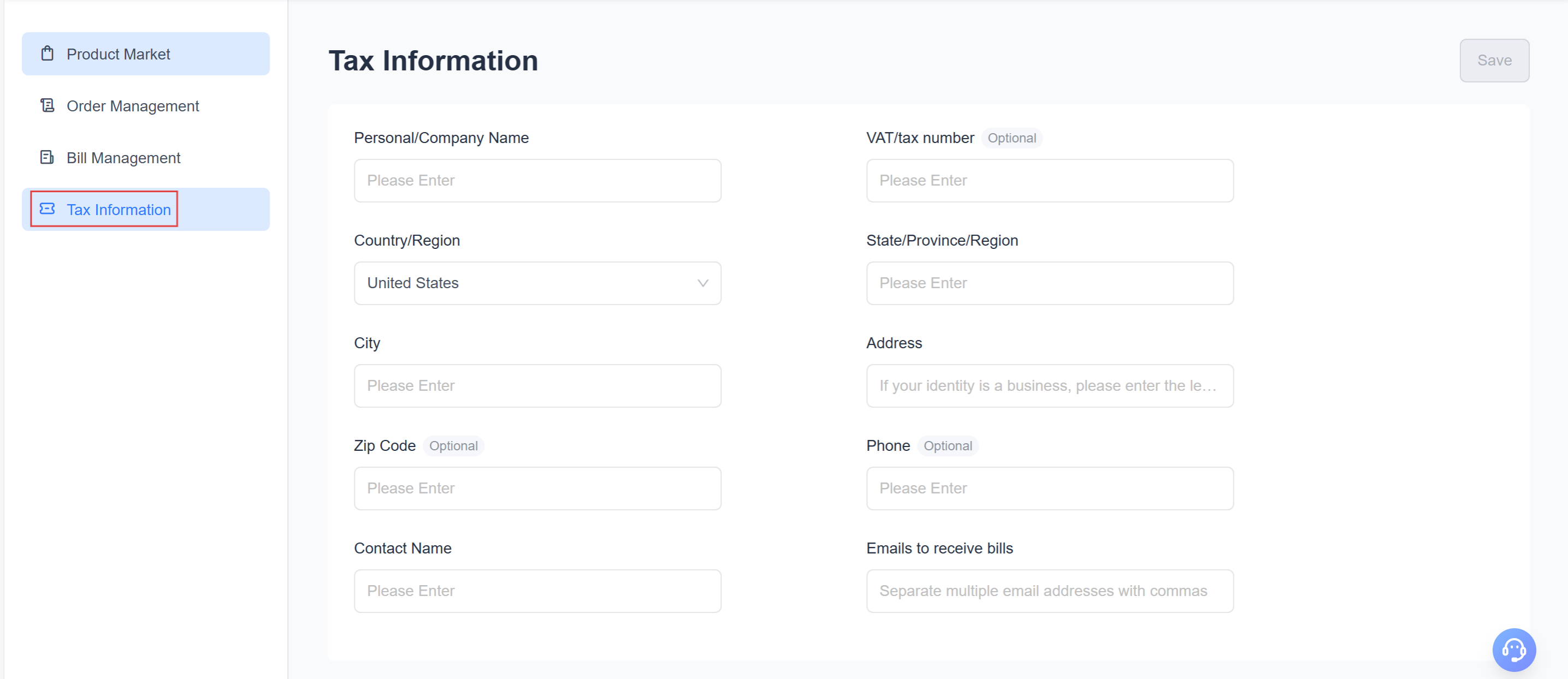

Tax Information Page

The Tax Information Page is designed to collect and manage corporate or individual tax details on the EngageLab platform. Completing tax information ensures smooth processes for order settlement, invoice issuance, and compliance with tax reporting.

Accessing the Page

To access the Tax Information Page, navigate to the "Order Management" or "Billing Management" page, then click "Tax Information" on the left navigation bar.

The page displays the tax information form for the current account, including basic company/individual information, tax number, address, contact person, etc.

Tax information can be modified at any time to ensure accuracy and compliance.

Field Descriptions

| Field | Description |

|---|---|

| Individual/Company Name | Enter the company name or individual name |

| VAT/tax number/UEN | Consumption tax, VAT taxpayer identification number, or Singapore-specific business registration number |

| Country/Region | Select the country or region where the company or individual is registered |

| State/Province/Region | Select the corresponding province or state |

| City | Enter the city |

| Address | Enter the detailed address |

| Postal Code | Postal code |

| Phone | Contact phone number |

| Contact Name | Name of the primary contact |

| Email Address | Email address for receiving bills, multiple addresses can be entered |

Required Information Description

Non-Singapore Regions: Individual/Company Name and Country/Region

Singapore Region: Individual/Company Name, Country/Region, UEN

If the tax information is incorrect, it can be modified. Once updated, the tax information in receipts or bills will automatically reflect the changes when downloaded again.