In insurance, the sale rarely happens at first contact. As an experienced agent, you know well that customers take time to compare policies, seek reassurance, and evaluate long-term value. And the key to finally making them choose and stay with you is none other than consistent and relevant communication over time. This is exactly what insurance email marketing enables you to do.

Email marketing for insurance agencies continues to outperform other channels for this specific industry. Unlike social media or paid ads, email offers a direct line to policyholders and prospects alike. Learn how to do it right and bring your agency to the next level.

The Strategic Role of Email Marketing for Insurance

Why is Email Marketing for Insurance Companies Essential?

Insurance products are very different compared to other goods. They are complex, long-term, and trust-driven. Email is the perfect fit for them as it allows insurers to educate, reassure, and stay present throughout the customer lifecycle. This is the reason why email insurance marketing brings such good results.

For agencies, in particular, email marketing for insurance supports three critical objectives:

- Enhance Customer Engagement and Policyholder Retention: Email enables insurers to stay connected across the entire customer lifecycle. You can create campaigns for onboarding new policyholders, educating clients on coverage details, sending renewal and payment reminders, and even upselling and cross-selling relevant products.

- Drive Revenue Growth Through Targeted Communication: For email marketing for life insurance, personalization is especially impactful, as tailoring messages based on life stage, family status, or financial goals significantly boosts conversions. Well-segmented email campaigns will also help you promote add-ons or premium upgrades, re-engage dormant leads, increase renewal rates with timely reminders, and introduce new insurance products at the right moment.

- Build Long-Term Client Relationships Through Trustworthy Communication: Unlike retail, insurance relationships last years. Consistent, helpful emails position your brand as a reliable advisor, not just a seller. For this reason, your insurance agent marketingstrategy should include educational emails, claims guidance, and policy tips to reinforce credibility and reduce churn.

Common Challenges in Insurance Email Marketing

Despite its advantages, email marketing insurance will present you with some unique challenges. First and foremost, cold outreach often struggles with low engagement, especially when messages feel generic or poorly timed. Another concern is deliverability, as sender reputation can suffer quickly if lists are outdated or improperly sourced.

And on top of these, compliance adds another layer of complexity. Regulations such as CAN-SPAM and GDPR demand strict consent management and data handling practices. Without the right systems in place, even well-intentioned campaigns can become liabilities.

Building an Effective Insurance Email Marketing List for Insurance Professionals

Every successful insurance agency email marketing strategy starts with a high-quality list. In fact, we can say that in this industry, list quality outweighs list size.

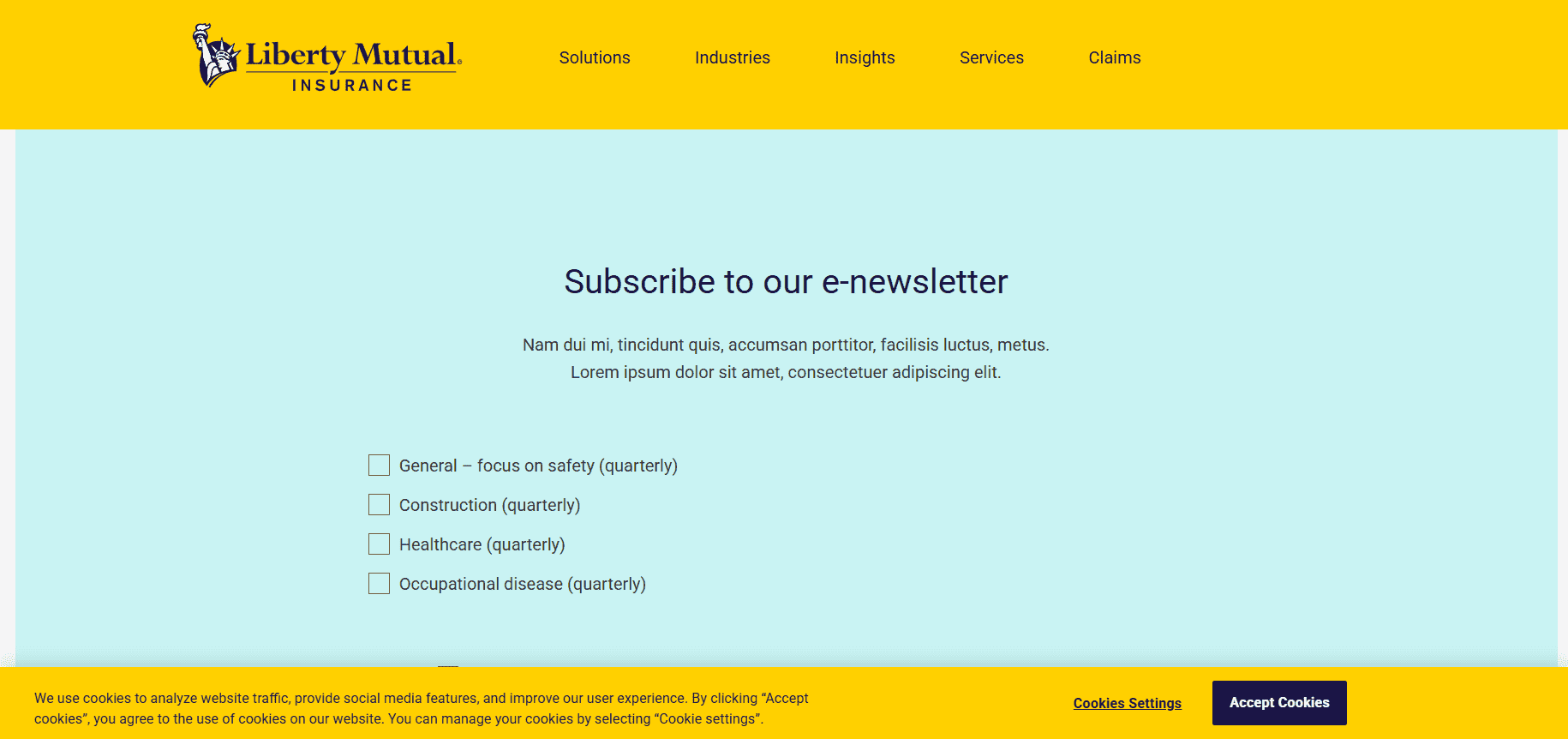

The most effective lists are built through transparent, permission-based methods. In the most successful insurance email marketing examples, the companies ask permission for the type of communications the prospects wish to receive. Moreover, they are transparent on the frequency of these communications.

Another tip that will help you become better is segmentation, which should begin as early as possible. Even basic distinctions, such as policy type or lead versus customer status, dramatically improve relevance. Over time, segmentation can evolve to include behavioral data, engagement history, and lifecycle milestones.

Equally important is to keep your list clean and updated. Remove inactive addresses regularly and honor unsubscribe requests, even if you feel like your list is shrinking. These practices will protect your email marketing life insurance deliverability and ensure that future campaigns reach real, interested recipients.

Types and Tactics of Insurance Email Marketing

An effective insurance email marketing strategy goes beyond sending occasional newsletters. It requires a structured mix of email types, each serving a clear purpose across the customer lifecycle. Below are nine essential types of insurance email marketing, with actionable tactics and content recommendations.

#1 Welcome and Onboarding Emails

Purpose: First impressions, trust-building, and expectation-setting

Welcome emails introduce subscribers to your agency and lay the foundation for future engagement. For email marketing for insurance agencies, this is where credibility begins tobe establishedh.

Content Recommendations:

- Clearly explain who you are and what makes your agency or company different,

- Set expectations for email frequency and content,

- Include direct contact details for agents or customer support,

- Guide users to the next step, such as booking a consultation or reviewing a policy guide.

Why it matters: Welcome emails typically achieve the highest open rates, making them a critical opportunity to establish trust early.

#2 Educational and Advisory Emails

Purpose: Authority-building and lead nurturing

Insurance is complex, and customers value brands that simplify it. Educational emails position your agency as a trusted advisor rather than a sales-driven entity. Email marketing for insurance agents should prioritize bringing something of value to the recipients.

Content Recommendations:

- Find topics that interest your clients, such as "How life insurance fits into long-term financial planning", "Common mistakes to avoid when choosing health insurance", or "What your auto policy really covers",

- Use simple language, visuals, and FAQs to improve comprehension and engagement.

Why it matters: These emails are particularly effective for email marketing life insurance, where customer decisions are long-term and emotionally driven.

#3 Lead Nurturing Drip Campaigns

Purpose: Convert prospects into policyholders

Many insurance leads aren’t ready to buy immediately. Drip campaigns deliver value gradually, addressing objections and building confidence. The following content recommendations are perfect for a drip campaign, suitable for email insurance marketing.

Content Recommendations:

- Share an educational overview of the different insurance options,

- Highlight real-life use cases or scenarios,

- Include testimonials or customer success stories,

- Use soft CTAs to consult an agent or request a quote.

Why it matters: This approach is core to insurance agent email marketing, where personal trust is a deciding factor.

#4 Policy Renewal Reminder Emails

Purpose: Retention and revenue protection

Renewals are one of the highest-ROI areas of email marketing for insurance companies. Set up an automated workflow to remind your policyholders in advance and reduce churn.

Content Recommendations:

- Start sending reminders well in advance,

- Use clear subject lines like "Your policy expires in 30 days",

- Include renewal benefits and support options,

- Add urgency without pressure.

Why it matters: Automated reminders reduce churn and prevent unintentional lapses.

#5 Cross-Sell and Upsell Emails

Purpose: Increase customer lifetime value

Existing customers are more likely to purchase additional coverage than new prospects, as they already know and trust your agency. For this reason, you should create highly personalized and relevant cross-sell emails.

Content Recommendations:

- Inform about life insurance riders for existing policyholders,

- Propose health add-ons based on family status,

- Promote home insurance for auto policy customers.

Why it matters: This tactic is essential for scalable insurance agency email marketing. If done successfully, it will significantly boost your ROI.

#6 Claims and Service Communication Emails

Purpose: Improve customer experience and reduce friction

Claims-related emails are often overlooked, even though they play a major role in customer satisfaction. For this, you should add them to your email insurance marketing strategy.

Content Recommendations:

- Send step-by-step claims instructions,

- Create required documentation checklists,

- Give status updates and timelines,

- Send post-claim follow-ups.

Why it matters: Clear communication during claims builds trust and significantly improves retention.

#7 Promotional and Seasonal Campaign Emails

Purpose: Drive short-term conversions

In email marketing for insurance agents, promotional emails should be used strategically to avoid overwhelming subscribers. These campaigns work best when combined with behavioral targeting and segmentation.

Content Recommendations:

- Year-end tax-saving insurance plans,

- Limited-time premium discounts,

- Seasonal coverage reminders like travel, health, and property plans.

Why it matters: Promotional emails nurture leads and create more sales.

#8 Re-Engagement Emails

Purpose: Reactivate inactive subscribers and protect deliverability

Inactive subscribers harmthe sender's reputation. Re-engagement campaigns help identify who still wants to hear from you.

Content Recommendations:

- Ask if subscribers want to continue receiving emails,

- Offer updated resources or consultations,

- Provide an easy unsubscribe option.

Why it matters: This practice keeps email insurance marketing lists clean and compliant.

#9 Customer Feedback and Survey Emails

Purpose: Insights and continuous improvement

In insurance email marketing templates, you will also find customer feedback campaigns. These will help you understand better the experience your policyholders have with your agency. At the same time, feedback emails also signal that your brand values customer opinions.

Content Recommendations:

- Request post-onboarding feedback,

- Conduct claims experience surveys,

- Do regular renewal satisfaction checks.

Why it matters: Surveys help your insurance company understand customer needs and pain points.

Implementing Successful Email Marketing for Insurance Companies with EngageLab

For enterprise insurers, executing these strategies consistently requires more than good intentions. It requires a platform built for scale, compliance, and automation. EngageLab is designed specifically to support complex email marketing for insurance companies operating across large audiences and long customer lifecycles.

Step 1: Secure List Development and Compliance for Email Marketing for Insurance

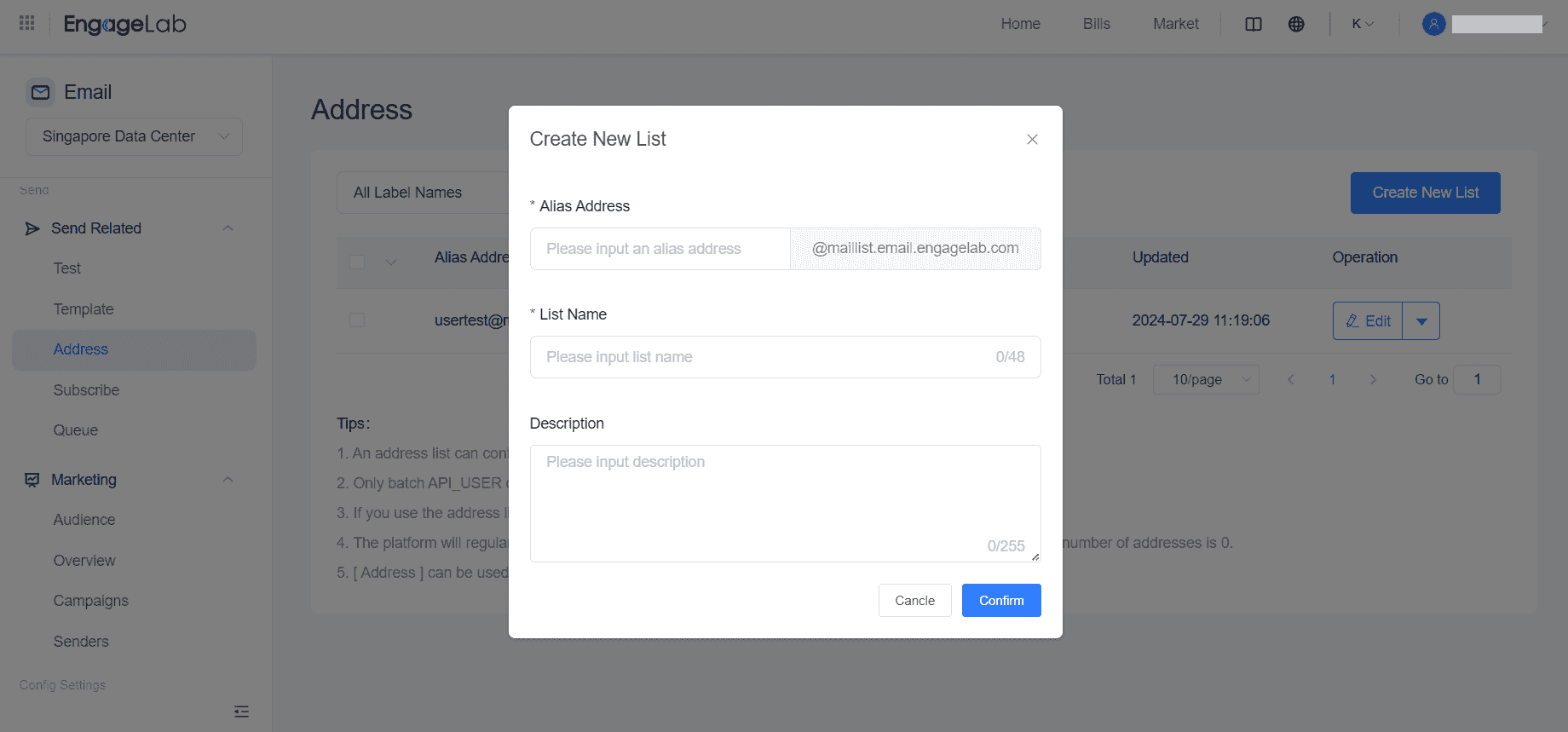

EngageLab enables your insurance agency to build and manage email lists with security and compliance at the core. The platform supports permission-based data collection and automated unsubscribe management, helping you meet regulatory requirements without adding operational complexity. By ensuring that every contact is verified and compliant, EngageLab protects sender reputation while laying a reliable foundation for long-term insurance email marketing success.

Step 2: Advanced Segmentation for Email Marketing Insurance Audiences

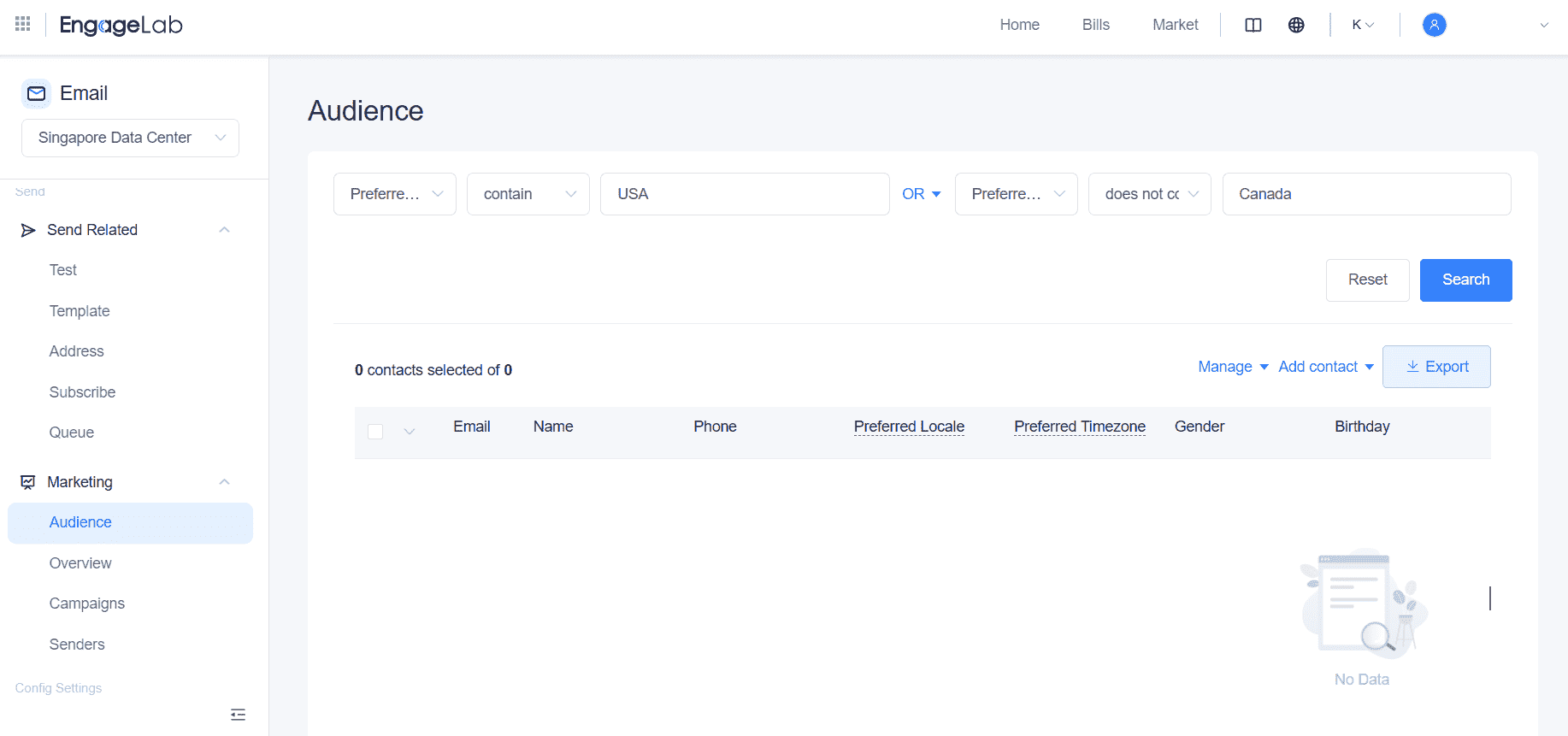

EngageLab’s advanced segmentation tools allow you to move beyond generic campaigns and speak to clearly defined audiences. Contacts can be segmented by policy type, lifecycle stage, engagement behavior, or custom attributes, making it easier to deliver messages that feel timely and relevant. This level of precision helps insurance email marketing campaigns achieve higher engagement while reducing unnecessary sends.

Step 3: Automated Customer Journeys for Email Insurance Marketing

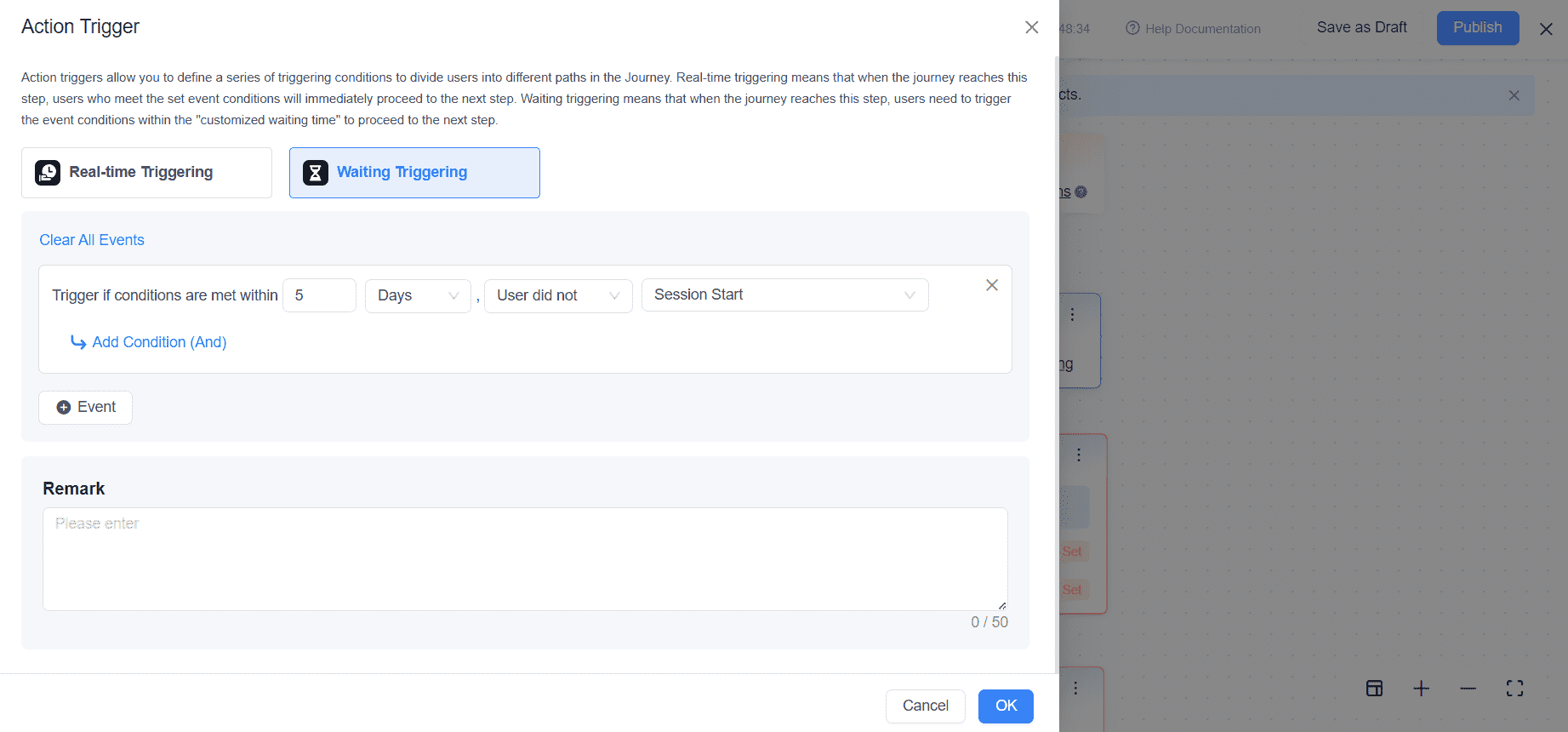

With EngageLab, your insurance agency can automate customer journeys that reflect real policyholder experiences. From onboarding sequences and lead nurturing flows to renewal reminders and claims-related updates, EngageLab ensures that communications are triggered at the right moment without manual intervention.

Step 4: High-Impact Content Creation with Insurance Email Marketing Templates

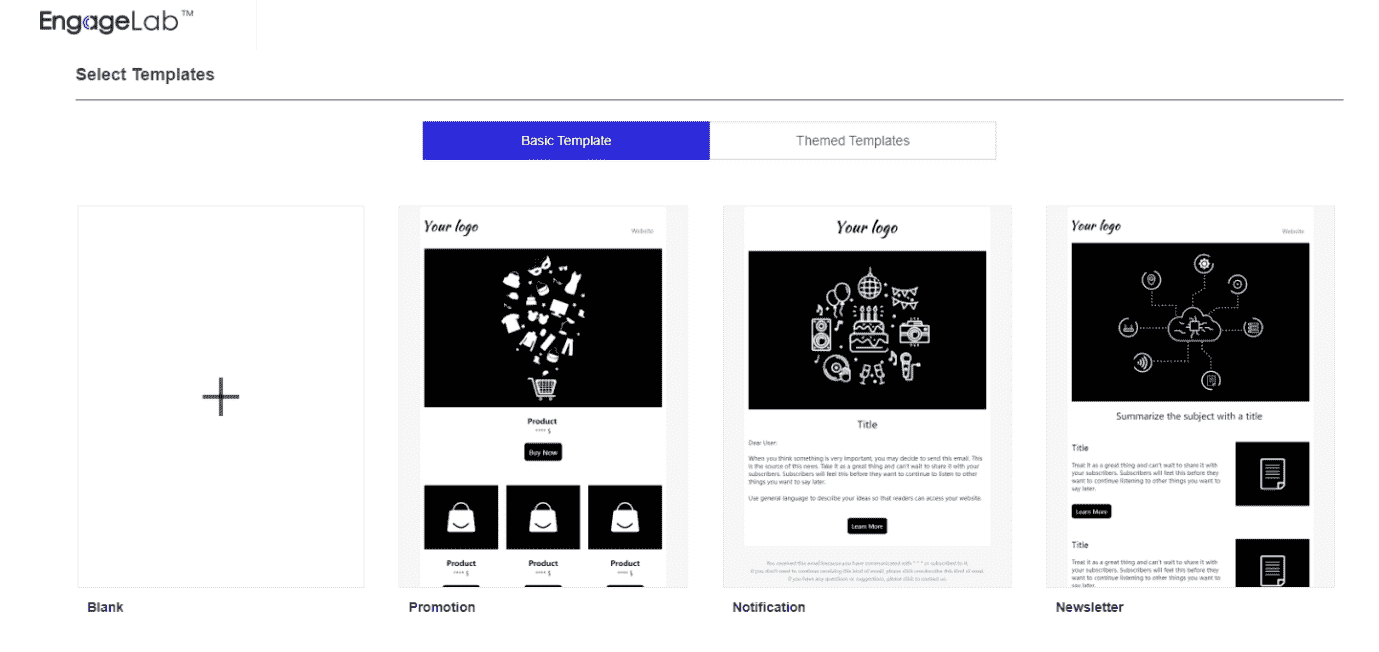

EngageLab provides customizable, mobile-responsive insurance email marketing templates designed to support clarity, compliance, and brand consistency. These templates help you present complex information in a clear and structured format. This way, you will be reducing design and production time without compromising quality or professionalism.

Step 5: Continuous Email Marketing Insurance Optimization

EngageLab offers comprehensive analytics and reporting that give your team clear visibility into campaign performance. In the real-time dashboards, you can monitor opens, clicks, conversions, and lifecycle engagement. This way, you can make data-driven decisions at every stage, thus continuously optimizing your campaigns.

Step 6: Deliverability and Sender Reputation in Insurance Email Marketing

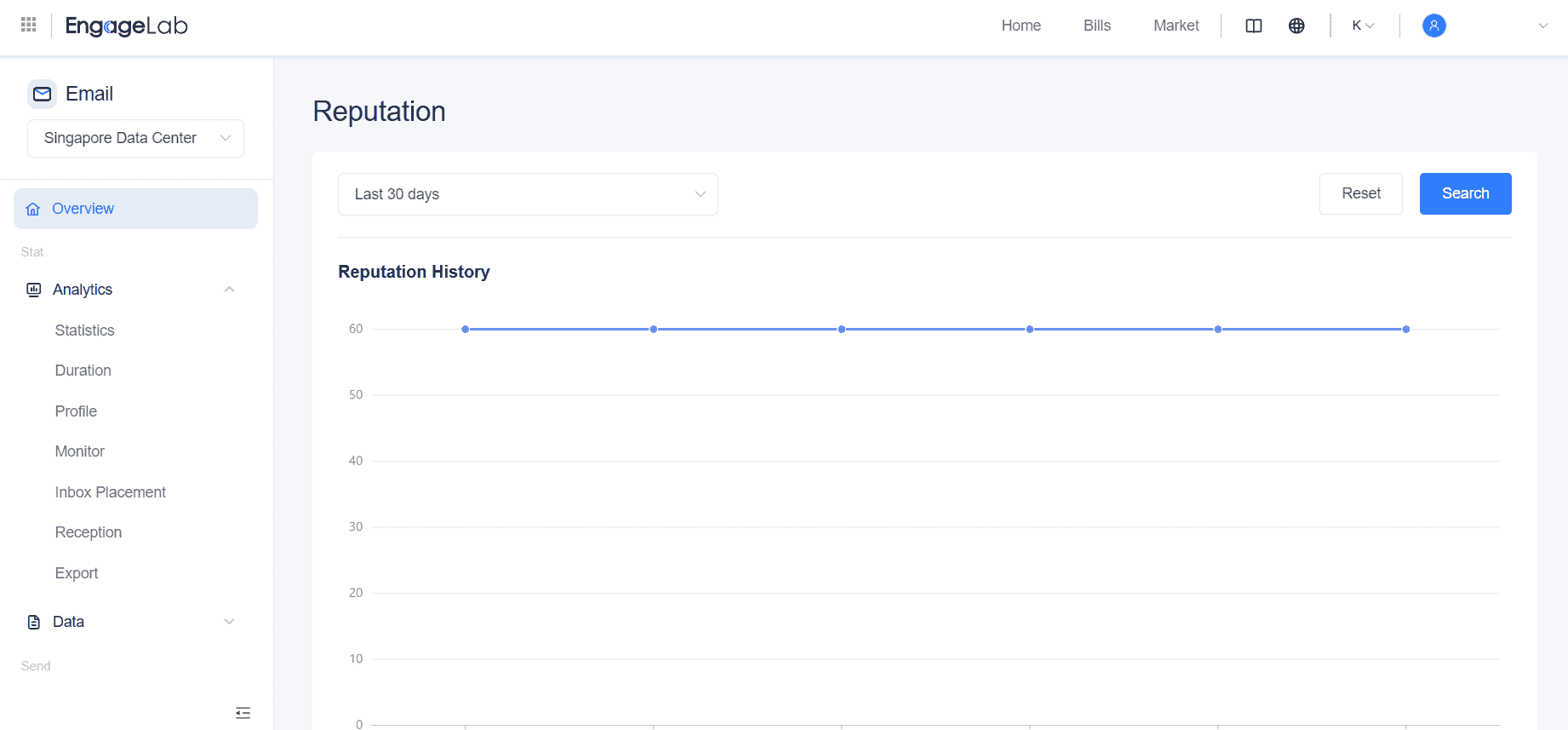

Deliverability is a core focus of EngageLab’s infrastructure. The platform provides tools for monitoring bounce rates, spam complaints, and engagement signals, which help you maintain a strong sender reputation. At the same time, you can also monitor your reputation history so that you can rest assured that your communications will land in your recipients’ inboxes.

In Conclusion

In an increasingly crowded insurance market, brands that communicate clearly and consistently stand apart. Email marketing for insurance remains one of the most effective ways to build trust, educate customers, and sustain long-term relationships. For insurers looking to scale effectively while improving engagement and retention, EngageLab offers the tools needed to turn communication into measurable growth. Now is the time to treat email not as a campaign, but as a core pillar of your insurance strategy.